IPL: Emerging Advertisement Religion

In India, cricket is equivalent to a religion. And the hype of this IPL season is surreal. The total advertisement spending for this year is supposed to touch INR 10,000 crore across television channels and digital platforms like JioCinema, with cricket swooping 90% of the total ad spending.

IPL is known for its celebrated sponsors from its former, broadcaster Star Sports has got seven sponsors in Thums Up, Amway, Jindal Steel and Power, Google, HDFC Life, Kajaria, and Policy Bazaar.

Viacom18 Media has bagged the digital right of T20 IPL for the years 2023-28. It has decided to stream IPL on JioCinema for free of cost.

Due to the impressive ratings that cricket has received on television since the final quarter of 2022, advertisers are showing enthusiasm toward it. This is believed to contribute to the projected 40% increase in IPL ad revenues for the upcoming season, including both TV and digital platforms.

“With the IPL being free this year, you may see digital come on par with TV regarding (audience) reach. This will be a big driver for the (ad) pricing. While TV ad revenue will be largely flattish, the share of digital for IPL ad revenue will increase and the ratio could be 60:40, with TV contributing 60 percent from 70 percent earlier,” said Rishabh Mahendru, VP, Client Success, AdLift.

Advertisers predict that due to the excellent rating IPL has received on television in its previous years, it is expected that IPL ad revenues across TV and digital are expected to grow by a high of 40% this year.

With Viacom18 onboarding more than 500 advertisers in this IPL season, it is expected to reach 550 million viewers this year.

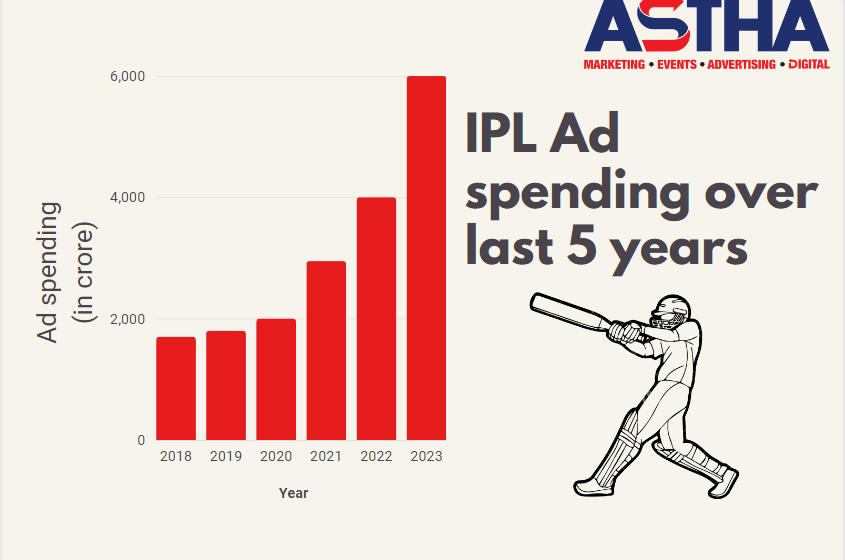

With estimated ad spending of INR 6,000 crore, INR 3,500-4,000 crore will go to television channels, while digital ad spending is expected to touch INR 2,000-2,500 crore, a 33-percent increase versus last year’s digital ad revenue, estimates Mahendru.

According to Karan Taurani, SVP at Elara Capital, the reason why IPL will attract a wider audience is because of an increase in games by 20%.

“IPL for free will push JioCinema’s subscriber base toward new records, as they may start to compete with the likes of YouTube India, which has an MAU base of 520 million, the largest in India,” said Taurani.

While digital advertising is expected to see significant results, it is also important to follow up the user traction. “How things pan out after the first year will depend on the user experience of the app and whether people are hooked to digital for the IPL,” he added.

JioCinema is focusing a lot on user experience (UX). it is taking steps towards increase in the number of fans’ engagement activities and initiatives to enhance UX. The targeting would be narrowed. They will analyze the user- its gender, location, and even the phone he is using. The ads would be run according to the user’s interests.

“Three key things that advertisers are essentially looking at this point, are measurability, scale, and zero wastage. In terms of measurability and scale, we’ll certainly be larger than television this year” said Anil Jayaraj, chief executive officer, sports, Viacom18 Media.

Undoubtedly the IPL is going to be a huge success, but at the end of the day, it becomes a very clustered market. Since marketers have a limited budget, they would have to choose where they should invest their money.

The bidding wars are going to be on and off. Nevertheless, cricket has a special place in the hearts of us Indians and would always be treated as a religion that binds every individual of this country.